Fire Damage Insurance Claims Adjuster In Port St. Lucie

We Will Help You Get The Most Out Of Your Fire Damage Insurance Claims

Fire Damage Attorney in Port St. Lucie: Why We Are The Right Lawyer For You

Fill Out Form

Fill out our quick form, and we’ll get started on evaluating your fire damage claim! No obligations.

We Maximize Your Claim

We’ll review your damage, negotiate with your insurance, and maximize your insurance claim.

Receive Your Settlement

Get your money quickly—so you can start rebuild your life!

Fires can sweep through Port St. Lucie neighborhoods like Tradition, St. Lucie West, or Sandpiper Bay in just minutes, but their effects can last for years. After the flames are out, local families face not only the loss of their homes and belongings—they must also navigate insurance claims, restoration challenges, and ongoing financial stress unique to the Port St. Lucie area.

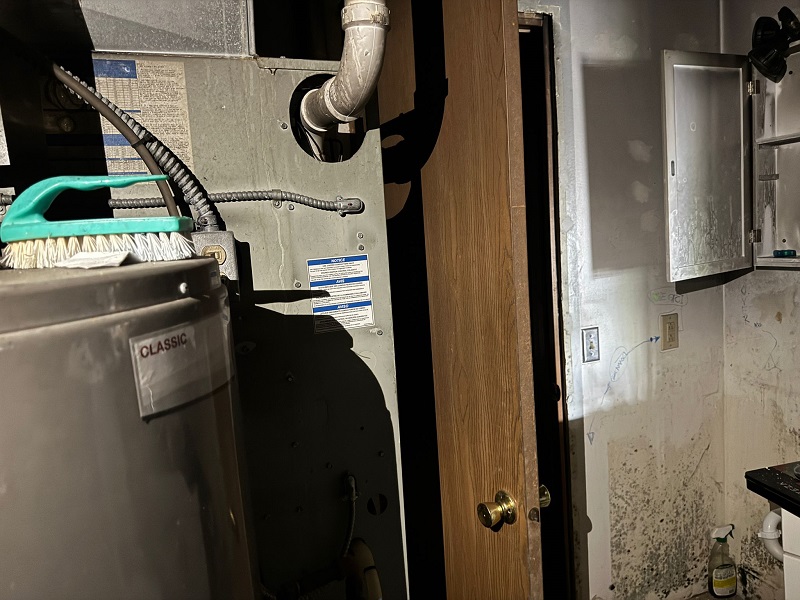

The true cost of fire damage extends far beyond initial estimates, with property owners often discovering hidden structural damage, toxic smoke residue, and extensive water damage from firefighting efforts. Insurance companies frequently undervalue these secondary damages, leaving families struggling to rebuild without adequate resources.

A skilled fire damage attorney serves as more than just legal representation – they become your advocate in steering the challenging recovery and restoration process.

These specialists understand the nuanced aspects of fire-related insurance claims, from identifying concealed structural compromises to ensuring fair compensation for temporary housing and lost personal property.

Professional legal guidance proves invaluable when dealing with insurance adjusters who may minimize claim values or overlook critical damage components. Fire damage attorneys use their expertise to document all losses comprehensively, negotiate effectively with insurance providers, and protect your right to full compensation under your policy.

Your path to recovery shouldn’t be compromised by insurance company tactics or overlooked damage assessment details. With proper legal support, you can focus on rebuilding while your attorney handles the complex process of securing the resources needed to restore your property and stabilize your financial future.

The Role Of A Fire Damage Attorney

After a fire in Port St. Lucie—whether you live in Tradition, St. Lucie West, or Sandpiper Bay—having a local fire damage attorney on your side is crucial. These legal experts help Port St. Lucie homeowners navigate complicated insurance claims and legal issues, working to ensure you get the fair compensation you deserve after a devastating loss

Key Areas Of Legal Expertise

Fire damage attorneys in Port St. Lucie neighborhoods—like Tradition, St. Lucie West, and Sandpiper Bay—bring essential local expertise to your case. They understand the unique challenges Port St. Lucie homeowners face and use their specialized knowledge to help you document losses, challenge insurance delays or denials, and fight for fair compensation so you can rebuild and recover:

• Comprehensive understanding of complex insurance policies and fire-related claims

• Expertise in structural damage assessment and documentation

• Detailed evaluation of personal property losses

• Analysis of additional living expenses and displacement costs

• Recognition of hidden damages, including smoke contamination

• Assessment of water damage from firefighting efforts

Fire Damage Claim Assistance in Port St. Lucie

Maximize Your Payout

We fight for your maximum settlement, ensuring you get every dollar you deserve!

Hassle-Free Claims Process

We handle everything—from documentation to negotiations—so you don’t have to.

No Upfront Fees

You don’t pay a dime until you get paid. We work on a contingency basis.

Faster Settlements

Get your fire damage claim processed quickly and efficiently.

Expert Representation

Our experienced adjusters know Port St. Lucie insurance laws inside and out.

Peace of Mind

Rest easy knowing that your claim is in expert hands, with full transparency throughout the process.

Get Fire Damage Insurance Claims Help in Port St. Lucie

If you want the best results from your fire damage insurance claim in Port St. Lucie—whether you’re in Tradition, St. Lucie West, or Sandpiper Bay—just fill out the form below. One of our local, experienced adjusters will contact you. There’s no obligation!

We Will Help You Get The Most Out Of Your Fire Damage Insurance Claims

How These Specialists Differ From General Practice Lawyers

Fire damage specialists serving Port St. Lucie neighborhoods like Tradition, St. Lucie West, and Sandpiper Bay offer focused expertise in property insurance law and fire-related claims. Their local knowledge includes navigating Port St. Lucie insurance processes, understanding city building codes, and handling challenges unique to our area’s climate and homes.

• Advanced understanding of structural engineering principles

• Detailed knowledge of smoke remediation requirements

• Expertise in current building code compliance

Specialized experience in challenging insurance valuations

• In-depth familiarity with fire damage assessment protocols

The Value of Specialized Legal Support

Fire damage attorneys serve as powerful advocates when dealing with insurance companies and their adjusters. These legal experts:

• Handle all communications with insurance representatives

• Negotiate aggressively for fair settlements

• Counter insurance company tactics to minimize payouts

• Investigate potential third-party liability

• Coordinate with fire investigators

• Prepare thorough litigation strategies when needed

Your attorney will help streamline the recovery process by:

• Creating detailed documentation of all losses

• Gathering and preserving crucial evidence

• Maintaining thorough communication records

• Ensuring compliance with claim-filing deadlines

• Coordinating with restoration experts

By partnering with a fire damage attorney, property owners gain access to detailed legal support that maximizes their recovery potential. These professionals work tirelessly to secure settlements covering:

• Full property restoration costs

• Temporary housing expenses

• Business interruption losses

• Long-term reconstruction needs

• Additional living expenses

• Personal property replacement

Their expertise proves invaluable in securing settlements that truly reflect the full scope of fire-related damages and the complete cost of restoration to pre-loss conditions.

When To Contact A Fire Damage Lawyer

Timing is crucial when dealing with fire damage claims. Seeking legal representation at the right moment can significantly impact your ability to receive fair compensation for your losses. Understanding these critical moments helps protect your rights and ensures proper handling of your claim.

Immediate Signs You Need Legal Help

Consider contacting a fire damage attorney immediately if:

• Your insurance company denies your claim

• You receive a settlement offer substantially lower than your estimated losses

• Your property suffers significant structural damage or total loss

•You’re dealing with complex commercial property damage

• Your business faces interruption losses

• You have damaged specialized equipment requiring valuation

Time Limitations For Filing Claims

Legal deadlines, known as statutes of limitations, govern the timeframe for filing fire damage claims and potential lawsuits. These critical deadlines vary by:

• Your specific jurisdiction

• Insurance policy requirements

• Type of claim filed

• Nature of the damage

Acting promptly is essential, as waiting too long can permanently compromise your right to compensation. A qualified fire damage attorney ensures all documentation and legal procedures meet these time-sensitive requirements.

Red Flags In Insurance Company Responses

Be alert to these concerning insurance company behaviors that indicate the need for legal representation:

• Unreasonable delays in claim investigation

• Slow or inconsistent payment processing

• Misrepresentation of policy coverage

• Incorrect interpretation of policy exclusions

• Incomplete damage assessments

• Disputes about fire cause or origin

• Requests for Examination Under Oath (EUO)

Insurance companies might attempt to minimize losses or dispute necessary repair costs. Having a legal advocate becomes particularly valuable when facing potential bad faith conduct or when determining third-party liability.

A fire damage attorney protects your interests by ensuring fair evaluation of replacement costs and complete coverage of all legitimate damages.

Services Provided By Fire Damage Attorneys

Fire damage attorneys provide essential legal support to help property owners move through the challenging aftermath of a fire. Their detailed services include in-depth policy analysis, damage assessment, insurance negotiations, and legal representation. Each service plays a crucial role in helping property owners secure fair compensation and protect their rights.

Insurance Policy Analysis

Fire damage attorneys conduct thorough reviews of insurance policies to maximize client benefits. Key aspects include:

• Identification of all available coverage types

• Analysis of additional living expenses provisions

• Review of temporary housing allowances

• Assessment of business interruption coverage

• Examination of specific policy exclusions and limitations

This detailed analysis ensures clients understand their rights while uncovering every potential avenue for compensation.

Damage Assessment And Documentation

Professional documentation forms the cornerstone of successful fire damage claims. The process includes:

- Collaboration with independent fire investigators

- Consultation with public adjusters

- Partnership with construction specialists

- Creation of detailed property damage inventories

- Documentation of:

- Structural damage

- Smoke and soot effects

- Water damage from firefighting

- Personal property losses

- Business equipment damage

Expert opinions and thorough documentation strengthen the claim’s value and support fair compensation requests.

Negotiation With Insurance Companies

Fire damage attorneys serve as powerful advocates during insurance negotiations, protecting clients’ interests through:

• Professional handling of all insurance company communications

• Strategic responses to settlement offers

• Presentation of compelling evidence

• Expert interpretation of policy terms

• Protection against unfair claim denials

These attorneys typically work on contingency fees, aligning their success with their clients’ positive outcomes. This arrangement ensures dedicated representation focused on securing maximum compensation.

Legal Representation In Court

When negotiations fail to yield fair results, fire damage attorneys provide skilled courtroom representation. Their litigation services cover:

• Filing and managing lawsuits

• Collecting and preserving evidence

• Interviewing witnesses and experts

• Presenting compelling legal arguments

• Pursuing claims against responsible third parties

• Handling appeals when necessary

This thorough legal approach ensures complete pursuit of all available compensation sources through appropriate legal channels. Whether dealing with insurance companies or third-party defendants, these attorneys work tirelessly to protect their clients’ interests.

The Claims Process With Legal Support

When you have legal representation for your fire damage claim, the process becomes more manageable and structured. Your attorney handles complex procedures while protecting your interests, giving you space to focus on rebuilding your life.

Initial Case Evaluation

Your attorney begins by conducting a thorough evaluation of your insurance policy, including:

• Identifying all applicable coverage types

• Reviewing policy exclusions and limitations

• Understanding your specific policyholder obligations

• Assessing claim strength and viability

This detailed review helps establish realistic expectations and creates a strategic roadmap for your claim’s success.

Evidence Collection Strategies

Strong documentation forms the foundation of a successful claim. Your legal team implements detailed evidence-gathering techniques through:

- Professional photography and video documentation

- Detailed inventories of damaged property

- Expert assessments from:

- Public adjusters

- Structural engineers

- Contents valuators

- Fire damage specialists

This methodical approach ensures every aspect of your loss receives proper documentation and expert validation.

Claim Filing Procedures

Your attorney manages all technical aspects of the claims process with precision and attention to detail:

• Preparing detailed Proof of Loss statements

• Meeting all policy requirements and legal deadlines

• Handling insurance company communications

• Maintaining detailed documentation records

Professional oversight helps avoid common pitfalls that could compromise your claim’s success, such as incomplete documentation or missed deadlines.

Settlement Negotiations

Your legal representative serves as a powerful advocate during settlement discussions by:

• Presenting compelling evidence of your losses

• Countering insurance company delay tactics

• Evaluating settlement offers against documented damages

• Protecting your interests throughout negotiations

If fair compensation isn’t offered, your attorney can pursue additional legal remedies, including litigation when necessary. This ensures you have strong representation through every phase of the settlement process.

Maximizing Your Fire Damage Compensation

Securing maximum compensation for fire damage requires careful attention to detail and thorough documentation. Professional legal representation often helps policyholders receive significantly higher settlements compared to handling claims independently. Let’s explore how you can ensure every legitimate damage is properly valued and claimed.

Types of Recoverable Damages

Fire damage compensation extends far beyond basic structural repairs. Here’s what you can typically recover:

• Structural repairs and rebuilding costs

• Personal property replacement

• Additional living expenses (ALE) during displacement

• Ecological restoration

• Smoke and soot remediation

• Lost rental income (for property owners)

A qualified attorney helps document and validate each damage category, ensuring your settlement reflects the true extent of your losses.

Hidden Damage Identification

Fire damage often lurks beneath the surface, creating long-term problems if left unaddressed. Consider these common hidden damages:

Smoke penetration in walls and insulation

Structural weakening from heat exposure

Compromised electrical systems

Water damage from firefighting efforts

HVAC system contamination

Foundation stress from extreme temperature change

Working with independent experts, including engineers and professional assessors, helps uncover and document these concealed issues before they worsen.

Long-term Impact Considerations

The effects of fire damage can emerge months or even years after the incident. Your compensation should account for:

• Potential structural deterioration

• Persistent smoke odors

• Future mold growth risks

• Air quality concerns

• Reduced property value

• Ongoing maintenance requirements

Professional legal assistance ensures your settlement addresses both immediate and future challenges, protecting you from unexpected expenses.

Additional Coverage Options

Your insurance policy may offer more protection than initially apparent. Key areas to explore include:

• Special endorsements and riders

• Code upgrade coverage

•Temporary housing allowances

• Business interruption coverage

• Extended replacement cost provisions

• Bad faith claim opportunities

A thorough policy review reveals these additional protections, potentially increasing your total compensation. When insurance companies unreasonably deny, delay, or underpay claims, you may have grounds for additional legal action.

Selecting the appropriate legal representation is crucial for maximizing your fire damage claim‘s success. A skilled attorney can significantly enhance your settlement outcome while protecting your interests throughout the claims process.

Essential Qualifications To Look For

- Specialized Experience

- Comprehensive expertise in fire damage insurance claims

- Focus on first-party property insurance law

- Proven track record with similar cases

- Local Knowledge

- Understanding of regional building codes

- Familiarity with fire investigation procedures

- Experience with local insurance practices

- Professional Standing

- Active state bar license

- Clean disciplinary record

- Strong reputation in the community

Questions To Ask During Consultation

Most fire damage attorneys provide free initial consultations to discuss your case. Make the most of this opportunity by asking these essential questions:

- Case Experience

- Number of similar cases handled

- Success rate with your insurance company

- Recent settlement examples

- Case Management

- Primary point of contact

- Communication frequency and methods

- Expected timeline for resolution

- Legal Strategy

- Approach to negotiations

- Trial experience and success rate

- Alternative dispute resolution options

Fee Structure And Payment Options

Understanding the financial arrangement with your attorney helps prevent future misunderstandings. Many fire damage attorneys operate on a contingency fee basis, ensuring their interests align with yours.

- Common Fee Arrangements

- Contingency fee percentages

- Case-related expenses

- Payment timeline

- Documentation Requirements

- Written fee agreement

- Expense tracking procedures

- Settlement distribution process

Request a detailed written agreement outlining all potential costs and payment responsibilities. This transparency ensures you fully understand the financial aspects of your legal representation while pursuing maximum compensation for your fire damage claim.

Frequently Asked Questions

Most fire damage attorneys operate on a contingency fee basis, meaning they receive payment only after successfully securing compensation for you. The fee typically ranges from 25% to 40% of your final settlement or award, based on case complexity.

While initial consultations are generally free, you may need to cover specific case-related expenses such as filing fees or expert witness costs, as outlined in your attorney-client agreement.

Essential documents to gather include:

• Your current homeowners or property insurance policy

• Photos and videos documenting fire damage

• A detailed inventory of damaged property with estimated values

• All insurance company correspondence

• Contractor repair estimates

• Official fire department and police reports

• Property ownership documentation (deed or mortgage statement)

While self-handling a fire damage claim is possible, professional legal representation often proves invaluable, particularly for complex cases or substantial damages.

Insurance companies employ skilled adjusters and legal teams to protect their interests. Without legal expertise, understanding detailed policy language and claim procedures can become challenging and potentially impact your settlement outcome.

The resolution timeline for fire damage claims typically spans from several months to over a year. Key factors affecting the duration include:

• Severity of property damage

• Complexity of the claim

• Insurance company response time

• Need for litigation

Claims requiring court intervention generally take longer due to legal procedures and scheduling requirements.

A claim denial doesn’t mark the end of your options. A qualified fire damage attorney can thoroughly review your:

• Denial letter

• Insurance policy terms

• Case specifics

Multiple paths forward may exist, including internal appeals, mediation, or legal action. Remember that strict time limits apply for challenging claim denials, making prompt legal consultation essential.

Fire damage attorneys primarily work on a contingency fee basis, with compensation calculated as a pre-established percentage of your recovery amount. This arrangement appears in a detailed written agreement at representation onset. The agreement clearly outlines:

• Fee percentage

• Payment terms

• Handling of case-related expenses

• Court filing fees

• Expert witness costs

While some attorneys may offer hourly rate options for specific services, contingency arrangements remain the most common fee structure.

Fire Damage Insurance Claims Help In Port St. Lucie

The aftermath of a fire can feel overwhelming, but you don’t have to handle this challenging time alone. Fire damage attorneys play a crucial role in helping you secure fair compensation for your losses, bringing both expertise and peace of mind to the recovery process.

Key was fire damage attorneys help:

• Interpret complex insurance policies in clear, understandable terms

• Document and claim all covered losses thoroughly

• Assess structural damage compensation

• Evaluate personal property losses

• Calculate additional living expenses

• Preserve time-sensitive evidence

• Meet critical filing deadlines

Quick action is essential after a fire. Having a qualified attorney step in early helps prevent costly communication mistakes with insurance companies while protecting your legal rights. Professional legal representation also allows you to focus on what matters most – rebuilding your life – while your attorney handles complex negotiations with insurance adjusters.

Here’s something reassuring: Most fire damage attorneys provide free initial consultations and work on a contingency fee basis. This means you’ll only pay legal fees after they successfully recover compensation for your losses. This arrangement ensures quality legal representation remains accessible during this difficult time.

With the right legal guidance, you can confidently move forward in securing the resources needed for a complete recovery. Understanding your rights and options through qualified legal counsel creates a clear path toward restoration and renewal.

Get Fire Damage Insurance Claims Help in Port St. Lucie

If want to get the most out of your fire damage insurance claim in Port St. Lucie, simply fill out the form below, and one of our experienced adjusters will reach out to you. No obligation!